nh food tax calculator

And all states differ in their enforcement of. The median property tax on a 24970000 house is 464442 in New Hampshire.

The New Hampshire bonus tax percent calculator will tell.

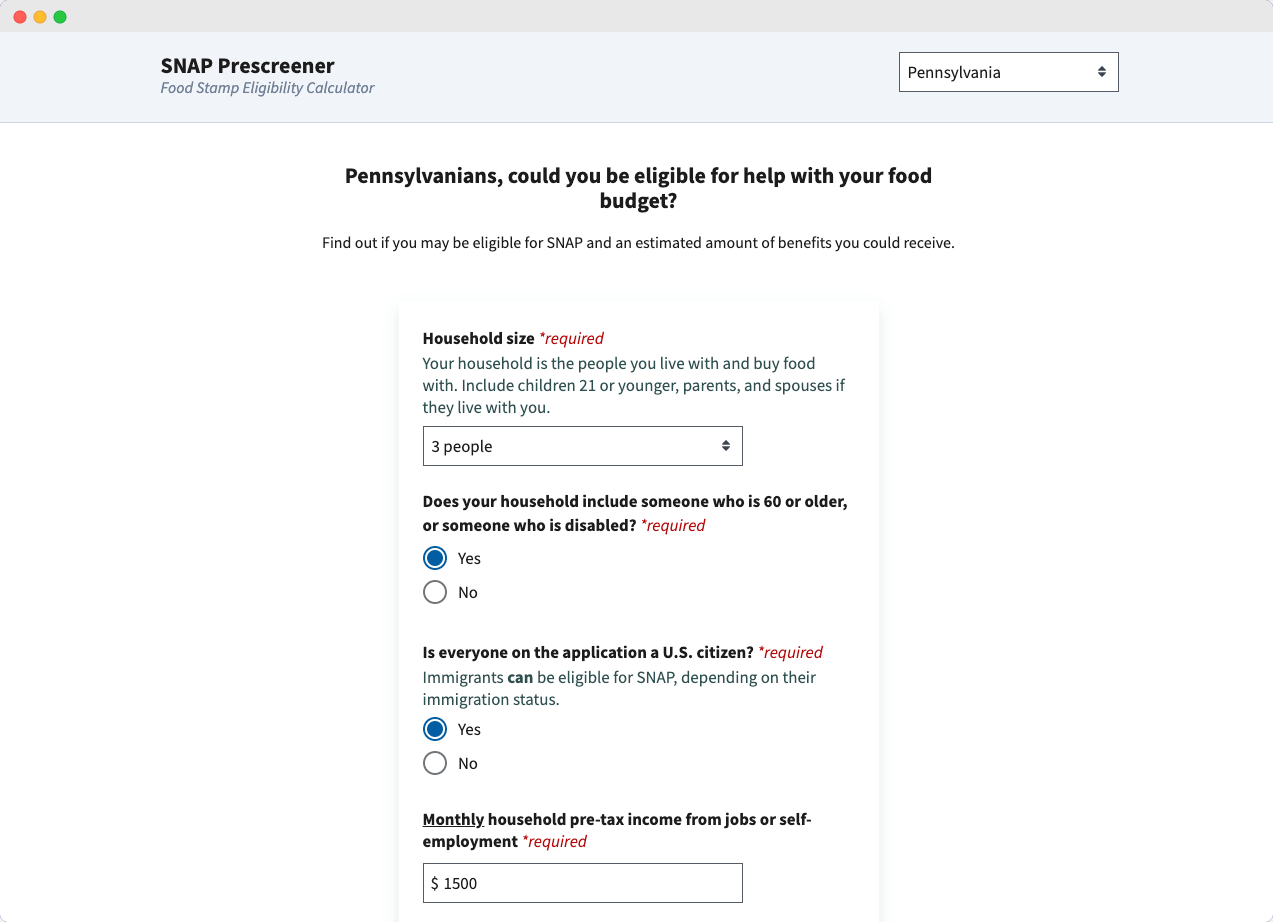

. Calculating your New Hampshire state income tax is similar to the steps we listed on our Federal paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Provides nutrition benefits to eligible low-income individuals and.

Also check the sales tax rates in different states of the US. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

For transactions of 4000 or less the minimum tax of. New Hampshire Income Tax Calculator 2021. Your average tax rate is 1198 and your.

Enter your info to see your take home pay. Students attending an institution of higher education like college university tradetechnical school are typically not eligible for SNAP unless they meet one of the exemptions below. Some rates might be different in Portsmouth.

A 9 tax is also assessed on motor vehicle rentals. Forms Documents. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more.

The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. So the tax year 2021 will start from July 01 2020 to June 30 2021. A 9 tax is also assessed on motor.

Free calculator to find the sales tax amountrate before tax price and after-tax price. 2022 New Hampshire state sales tax. New Hampshire Hourly Paycheck Calculator.

For the latest on COVID-19 in New Hampshire go to wwwcovid19nhgov. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. New Hampshires sales tax rates for commonly exempted categories are listed below. For additional assistance please call the Department of Revenue Administration at 603.

![]()

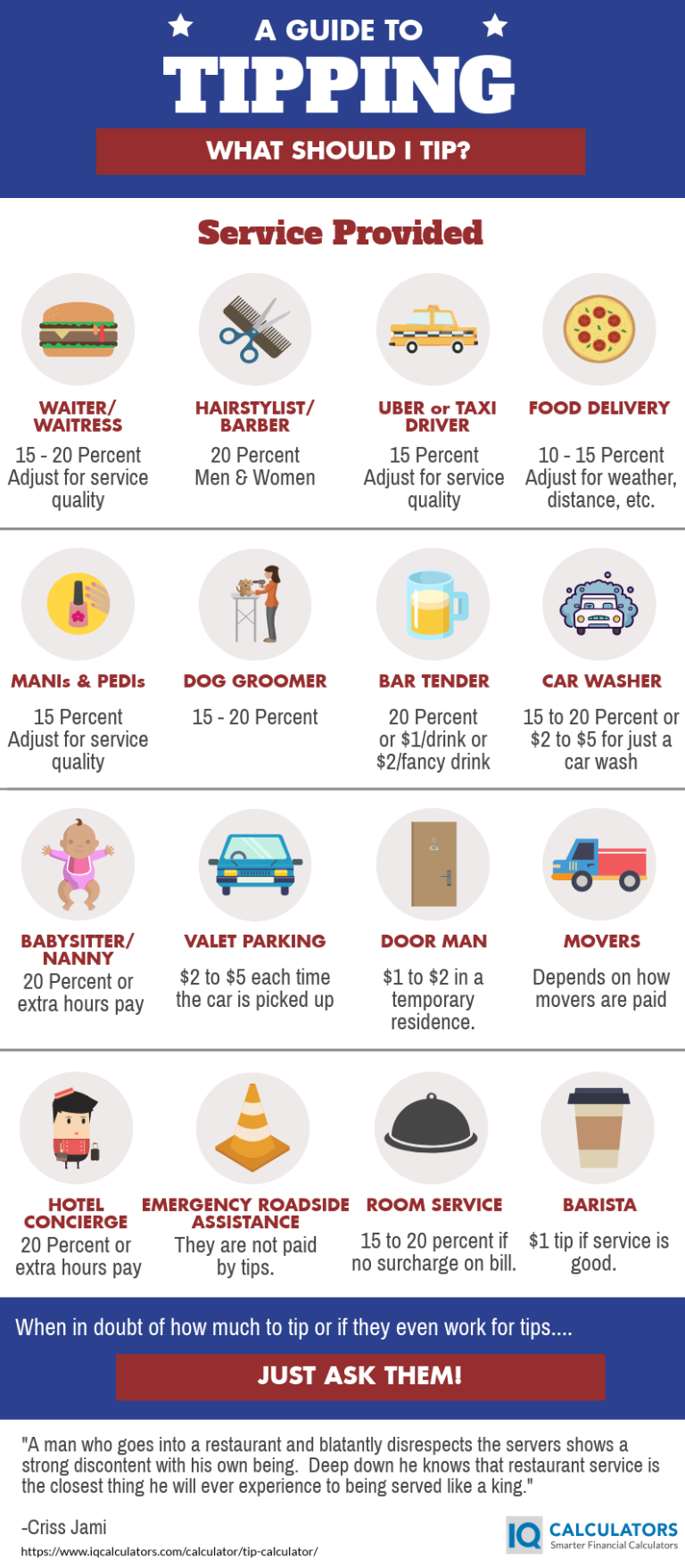

Snap Eligibility Calculator 50 State Food Stamp Prescreener

Sales Tax On Grocery Items Taxjar

What You Need To Know To File Taxes In 2022 Get It Back

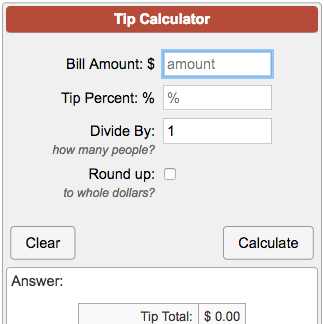

Tip Calculator Free Tip Calculator App

Do You Know How To Calculate Sales Tax For Your Business

Calculator Financial Reporting Cookies Polymer Clay Crafts Sugar Cookies Decorated Cookie Decorating

Income Tax Calculator 2021 2022 Estimate Return Refund

Amazon Com Dm41l Office Products

Snap Eligibility Calculator 50 State Food Stamp Prescreener